To connect with me directly, contact me at 917-254-2103. For your FREE Home evaluation to learn the value of your home, your Homeowner Resource Guide, or your Home Buying/Down Payment Assistance Guide, use this link: https://bit.ly/45URvuV or text Ho

Thinking About Using Your 401(k) To Buy a Home?

**For a FREE down payment assistance guide, use this link: https://bit.ly/45URvuV**

Are you dreaming of buying your own home and wondering about how you’ll save for a down payment? You're not alone. Some people think about tapping into their 401(k) savings to make it happen. But before you decide to dip into your retirement to buy a home, be sure to consider all possible alternatives and talk with a financial expert. Here’s why.

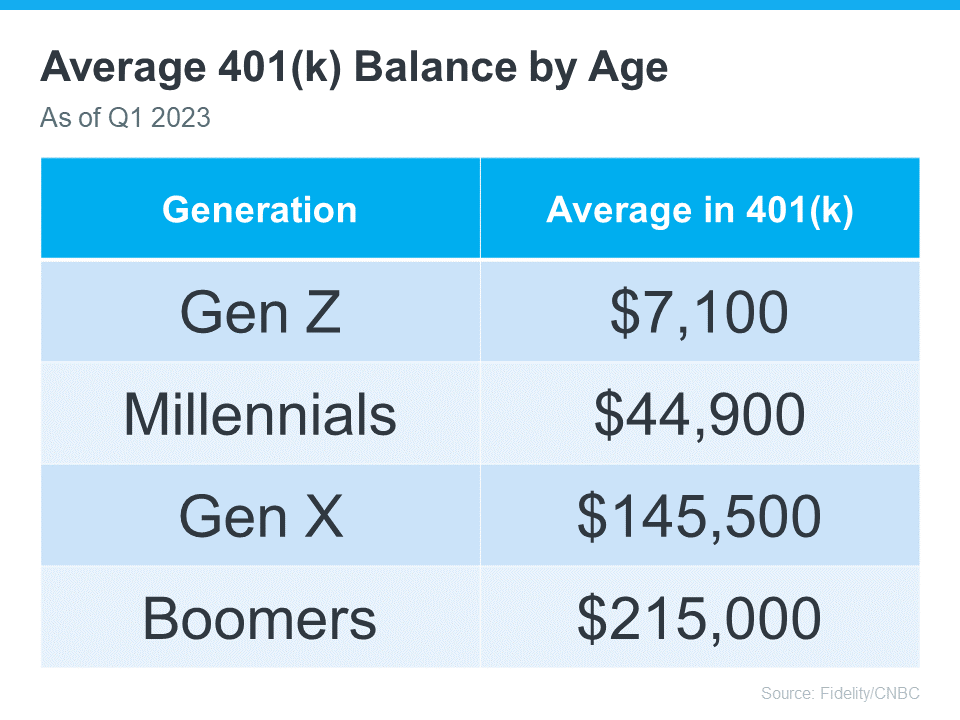

The Numbers May Make It Tempting

The data shows many Americans have saved a considerable amount for retirement (see chart below):

It can be really tempting when you have a lot of money saved up in your 401(k) and you see your dream home on the horizon. But remember, dipping into your retirement savings for a home could cost you a penalty and affect your finances later on. That's why it's important to explore all your options when it comes to saving for a down payment and buying a home. As Experian says:

“It’s possible to use funds from your 401(k) to buy a house, but whether you should depends on several factors, including taxes and penalties, how much you’ve already saved and your unique financial circumstances.”

Alternative Ways To Buy a Home

Using your 401(k) is one way to finance a home, but it's not the only option. Before you decide, consider a couple of other methods, courtesy of Experian:

FHA Loan: FHA loans allow qualified buyers to put down as little as 3.5% of the home's price, depending on their credit scores.

Down Payment Assistance Programs: There are many national and local programs that can help first-time and repeat homebuyers come up with the necessary down payment.

Above All Else, Have a Plan

No matter what route you take to purchase a home, be sure to talk with a financial expert before you do anything. Working with a team of experts to develop a concrete plan prior to starting your journey to homeownership is the key to success. Kelly Palmer, Founder of The Wealthy Parent, says:

“I have seen parents pausing contributions to their retirement plans in favor of affording a larger home often with the hope they can refinance in the future… As long as there is a tangible plan in place to get back to saving for their retirement goals, I encourage families to consider all their options.”

Bottom Line

If you’re still thinking about using your 401(k)-retirement savings for a home down payment, consider all your options and work with a financial professional before you make any decisions.

To connect with me directly, contact me at 917-254-2103. For your FREE Home evaluation to learn the value of your home, your Homeowner Resource Guide, or your Home Buying/Down Payment Assistance Guide, use this link: https://bit.ly/45URvuV or text Ho

Why Buying Before Spring Could Save You Money If you’re thinking about buying a home this year, chances are spring is already on your radar. That’s when more listings usually show up, more buyers jump back into the market, and open houses

To connect with me directly, contact me at 917-254-2103. For your FREE Home evaluation to learn the value of your home, your Homeowner Resource Guide, or your Home Buying/Down Payment Assistance Guide, use this link: https://bit.ly/45URvuV or text Ho

To connect with me directly, contact me at 917-254-2103. For your FREE Home evaluation to learn the value of your home, your Homeowner Resource Guide, or your Home Buying/Down Payment Assistance Guide, use this link: https://bit.ly/45URvuV or text Ho