To connect with me directly, contact me at 917-254-2103. For your FREE Home evaluation to learn the value of your home, your Homeowner Resource Guide, or your Home Buying/Down Payment Assistance Guide, use this link: https://bit.ly/45URvuV or text Ho

The Best Way To Keep Track of Mortgage Rate Trends

To connect with me directly, contact me at 917-254-2103. For your FREE Home evaluation to learn the value of your home, your Homeowner Resource Guide, or your Home Buying/Down Payment Assistance Guide, use this link: https://bit.ly/45URvuV or text HomeswithJustin to 85377.

If you’re thinking about buying a home, chances are you’ve got mortgage rates on your mind. You’ve heard about how they impact how much you can afford in your monthly mortgage payment, and you want to make sure you’re factoring that in as you plan your move.

The problem is, with all the headlines in the news about rates lately, it can be a bit overwhelming to sort through. Here’s a quick rundown of what you really need to know.

The Latest on Mortgage Rates

Rates have been volatile – that means they’re bouncing around a bit. And, you may be wondering, why? The answer is complicated because rates are affected by so many factors.

Things like what’s happening in the broader economy and the job market, the current inflation rate, decisions made by the Federal Reserve, and a whole lot more have an impact. Lately, all of those factors have come into play, and it’s caused the volatility we’ve seen. As Odeta Kushi, Deputy Chief Economist at First American, explains:

“Ongoing inflation deceleration, a slowing economy and even geopolitical uncertainty can contribute to lower mortgage rates. On the other hand, data that signals upside risk to inflation may result in higher rates.”

Professionals Can Help Make Sense of it All

While you could drill down into each of those things to really understand how they impact mortgage rates, that would be a lot of work. And when you’re already busy planning a move, taking on that much reading and research may feel a little overwhelming. Instead of spending your time on that, lean on the pros.

They coach people through market conditions all the time. They’ll focus on giving you a quick summary of any broader trends up or down, what experts say lies ahead, and how all of that impacts you.

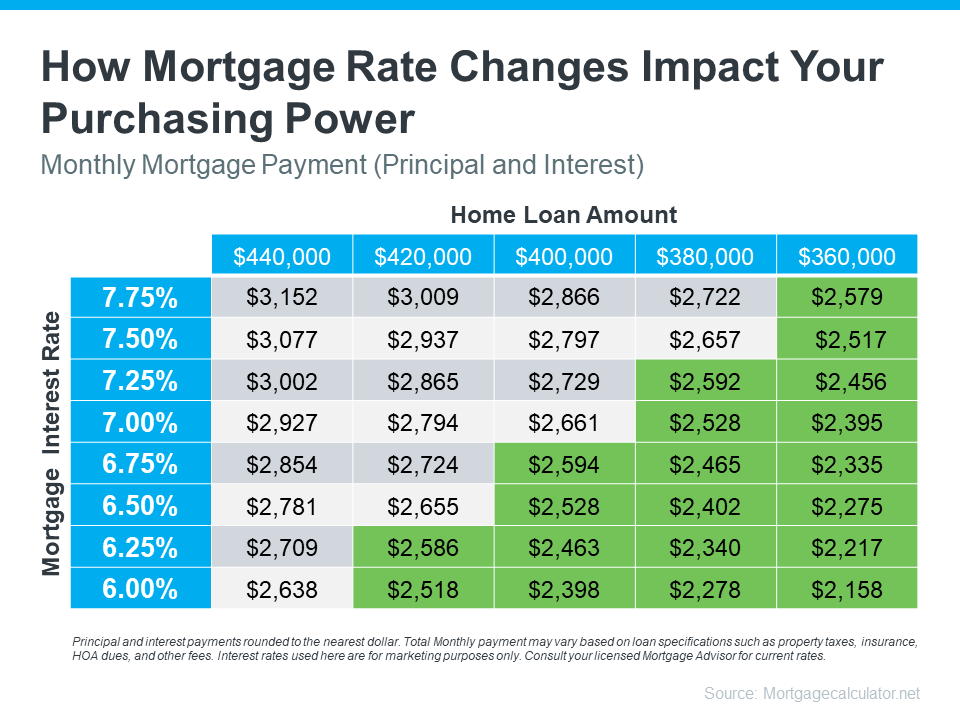

Take this chart as an example. It gives you an idea of how mortgage rates impact your monthly payment when you buy a home. Imagine being able to make a payment between $2,500 and $2,600 work for your budget (principal and interest only). The green part in the chart shows payments in that range or lower based on varying mortgage rates (see chart below):

As you can see, even a small shift in rates can impact the loan amount you can afford if you want to stay within that target budget.

It’s tools and visuals like these that take everything that’s happening and show what it actually means for you. And only a pro has the knowledge and expertise needed to guide you through them.

You don’t need to be an expert on real estate or mortgage rates, you just need to have someone who is, by your side.

Bottom Line

Have questions about what’s going on in the housing market? Connect with me to take what’s happening right now and figure out what it really means for you. My direct number is 917-254-2103.

To connect with me directly, contact me at 917-254-2103. For your FREE Home evaluation to learn the value of your home, your Homeowner Resource Guide, or your Home Buying/Down Payment Assistance Guide, use this link: https://bit.ly/45URvuV or text Ho

To connect with me directly, contact me at 917-254-2103. For your FREE Home evaluation to learn the value of your home, your Homeowner Resource Guide, or your Home Buying/Down Payment Assistance Guide, use this link: https://bit.ly/45URvuV or text Ho

To connect with me directly, contact me at 917-254-2103. For your FREE Home evaluation to learn the value of your home, your Homeowner Resource Guide, or your Home Buying/Down Payment Assistance Guide, use this link: https://bit.ly/45URvuV or text Ho

To connect with me directly, contact me at 917-254-2103. For your FREE Home evaluation to learn the value of your home, your Homeowner Resource Guide, or your Home Buying/Down Payment Assistance Guide, use this link: https://bit.ly/45URvuV or text Ho