Buying a home is one of the most exciting—and financially significant—decisions you'll ever make. But while many buyers focus on saving for the down payment and calculating their monthly mortgage, there’s a lot more to the picture t

Why Moving to a Smaller Home After Retirement Makes Life Easier

To connect with me directly, contact me at 917-254-2103. For your FREE Home evaluation to learn the value of your home, your Homeowner Resource Guide, or your Home Buying/Down Payment Assistance Guide, use this link: https://bit.ly/45URvuV or text HomeswithJustin to 85377.

Retirement is a time for relaxation, adventure, and enjoying the things you love. As you imagine this exciting new chapter in your life, it’s important to think about whether your current home still fits your needs.

If it’s too big, too costly, or just not convenient anymore, downsizing might help you make the most of your retirement years. To find out if a smaller, more manageable home might be the perfect fit for your new lifestyle, ask yourself these questions:

- Do the original reasons I bought my current house still stand, or have my needs changed since then?

- Do I really need and want the space I have right now, or could somewhere smaller be a better fit?

- What are my housing expenses right now, and how much do I want to try to save by downsizing?

If you answered yes to any of these, consider the benefits that come with downsizing.

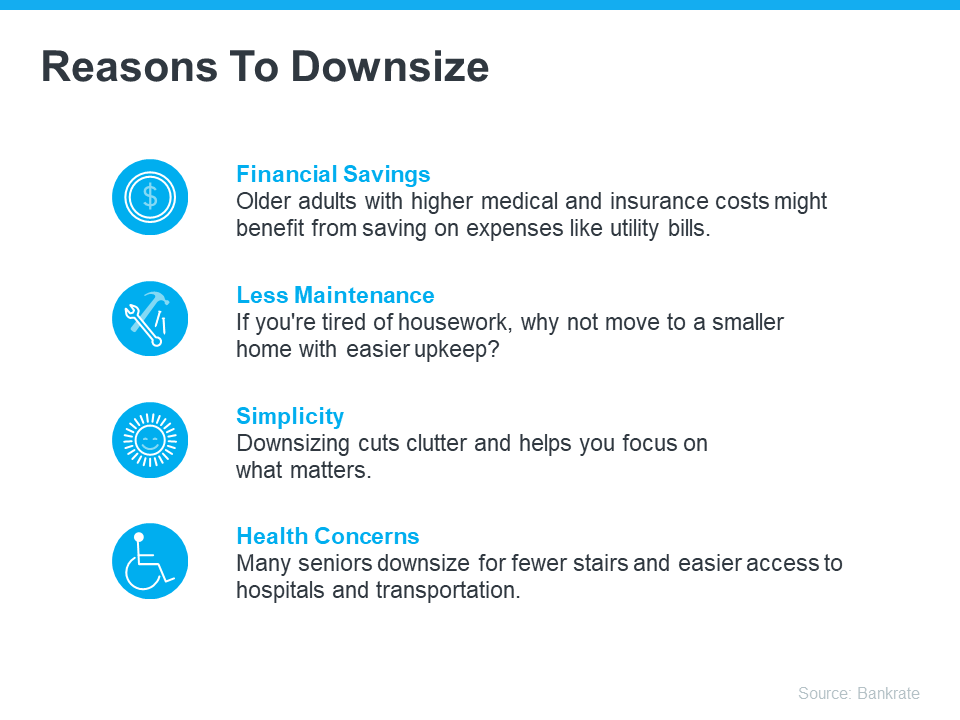

The Benefits of Moving into a Smaller Home

There are many reasons why you should downsize. Here are just a few from Bankrate:

Your Equity Can Help Make Downsizing Possible

If those perks sound like something you’d want, you may already have what you need to make it happen. A recent article from Seniors Guide shares:

“And at a time when homeowners age 62 and older have more than $12 trillion in home equity, downsizing makes sense . . .”

If you’ve been in your house for a while, odds are you’re one of those homeowners who’s built up a considerable amount of equity. And that equity is something you can use to help you buy a home that better fits your needs today. Greg McBride, Chief Financial Analyst at Bankrate, explains:

“Downsizing can mean taking that equity when the home is sold and using it to pay cash or make a large down payment on a lower-priced home, reducing your monthly living expenses.”

When you’re ready to use all that equity to fuel your next move, your real estate agent will be your guide through every step of the process. That includes setting the right price for your current house when you sell, finding the home that best fits your evolving needs, and understanding what you can afford at today’s mortgage rate.

Bottom Line

Starting your retirement journey? Think about downsizing – it could really help. When you're ready, connect with me at 917-254-2103. My goal is to help you accomplish yours!

**To connect with me directly, contact me at 917-254-2103. For your FREE home buying guide and/or down payment assistance guide, use this link: https://bit.ly/45URvuV or text HomeswithJustin to 85377.** If you’ve been holding off on

Buying a home is one of the most exciting—and financially significant—decisions you'll ever make. But while many buyers focus on saving for the down payment and calculating their monthly mortgage, there’s a lot more to the picture t